What is a Charitable Lead Trust?

PRwire360

02 Feb 2023, 01:26 GMT+10

How does it work? What type of client might benefit from using one?

A charitable lead trust (CLT) is the opposite of a charitable remainder trust. An irrevocable trust provides a selected charity with an annual income. The remainder of the trust's assets is subsequently dispersed to the donor's relatives or other beneficiaries selected by the donor. CLTs are established for years or for the lives of one or more beneficiaries, during which charitable contributions are made. A CLT can be established either during the donor's lifetime or via his or her will. Potential CLT advantages include estate tax savings, gift tax savings, and even income tax deductions.

The operation of a charitable lead trust

For a donor's lifetime or a defined number of years, the trust is funded by the donor's assets. The trust can be funded using real estate, publicly traded stock, cash, and other assets if it complies with IRS regulations. The charity accepts payments in one of two ways:

- A constant annuity payment. A specified amount is paid annually.

- A percentage payout is termed a unitrust payment. A specified percentage of the value of the trust is distributed annually.

The distributions may be made more frequently than annually, but the total annual payments must adhere to the limits established by the trust deed. Creating trust involves compliance with specific IRS regulations. An experienced Arizona attorney in charitable trusts and estate planning can assist you through IRS restrictions. At the trust's termination, the assets are either returned to the grantor or dispersed to the named beneficiaries.

Different kinds of charitable lead trusts

Two types of CLTS can impact tax matters. There are benefits and drawbacks to each type:

- A philanthropic lead grantor trust. Here, the donor/grantor can claim an income tax charitable deduction based on the present value of the future payments that will be made to the designated charity beneficiaries. The eligibility for the tax deduction and the amount of the authorized deduction may depend on whether the charity is a public or private foundation. During the trust's duration, any investment income (money created by the CLT) is taxable to the donor.

- Non-donor-directed charitable lead trust Here, the trust, not the grantor, is deemed the trust's owner. This means the grantor cannot claim the charitable income tax deduction, although the grantee can. Additionally, the trust pays taxes on any investment income.

Key Benefits

Among the benefits to consider are the following:

Tax exemptions Cash contributions may qualify for a partial tax break for the donor. To qualify for the income tax deduction, stocks may need to be sold first.

Contributing to a cause of your choosing. You can add a charity and observe it as it grows and assists its intended beneficiaries. In contrast to charitable residual trusts, there is no time limit on the duration of these philanthropic payments. Additionally, no minimum or maximum amount must be delivered as income so long as distributions are paid at least annually.

Additional tax benefits The distribution after the trust's term may decrease or eliminate other taxes on the dispersed amount.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Indianapolis Post news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Indianapolis Post.

More InformationBusiness

SectionMcDonald’s to shut down CosMc’s drink spinoff after short run

CHICAGO, Illinois: McDonald's is closing its experimental beverage spinoff, CosMc's, less than two years after launching the standalone...

China’s Lenovo profit plunges 64%, misses estimates sharply

BEIJING, China: China's Lenovo reported a steep 64 percent drop in fourth-quarter profit, falling significantly short of analyst expectations...

Economic data gives welcome relief to Wall Street

NEW YORK, New York - Strong economic data jump-started U.S. stocks and the dollar Tuesday, a welcome reprieve after weeks of pressure...

PepsiCo cleared in FTC case over Walmart discounts

NEW YORK CITY, New York: This week, the U.S. Federal Trade Commission (FTC) dropped its lawsuit against PepsiCo, which had accused...

Builder discounts drive sales spike, but housing outlook wary

WASHINGTON, D.C.: New single-family home sales in the U.S. rose sharply in April to their highest level in over three years as builders...

CEO says health push weakened Nestle, vows return to F&B roots

VEVEY, Switzerland: Nestle is realigning its focus on its core food and beverage operations after expanding into areas like health...

International

SectionHistoric vote for judges in Mexico marred by criminal ties

CIUDAD JUAREZ, Mexico: In a first-of-its-kind judicial election in Mexico, more than 5,000 candidates are vying for over 840 federal...

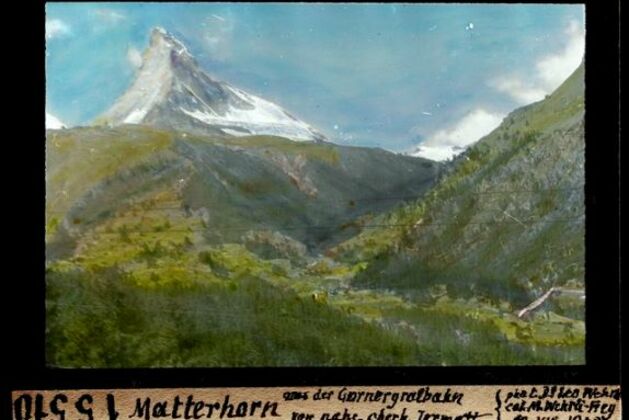

Bodies of 5 missing skiers recovered on mountain in Switzerland

ZERMATT, Switzerland: Five skiers were found dead on a mountain in Switzerland near the popular ski resort of Zermatt, officials said...

Canadians turn out in thousands to pay tribute to Israel

TORONTO, Canada - Tens of thousands of people from across Canada have marched in support of Israel in a massive turnout in Toronto....

Foreign students at Harvard bear the brunt of White House ban

BOSTON, Massachusetts: U.S. President Donald Trump's administration has taken away Harvard University's right to enroll international...

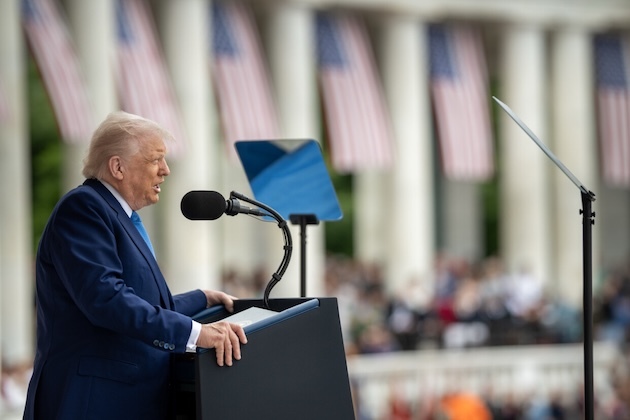

God responsible for his presidency, claims Trump

WASHINGTON, DC - U.S. President Donald Trump on Monday said he believed God was behind his election loss in 2020, even though he has...

Passenger traffic plummets at Newark Airport amid travel disruptions

NEW YORK CITY, New York: Passenger numbers at Newark Liberty International Airport in New Jersey have dropped sharply, according to...